Of many prospective consumers are interested in possessions and wish to see whenever you can score home financing in the place of long lasting a position. House is perhaps one of the most common investments, whether or not private use or for financial support objectives. It is reduced in risk and relatively predict a possessions you ordered are value alot more the coming year.

Of several potential customers become builders for the a fixed name or endeavor base. Most are freelancers or separate builders in the latest concert discount. There’s another procedure to get home financing whenever one-man shop, which is different to being employed to your an agreement that is normally offered. Right here we have been covering the condition where you are utilized by a buddies, yet not into the a non-permanent foundation.

There is a very common thoughts you to to obtain home financing you should have a long-term employment. That it rationale makes sense due to the fact a home loan is usually to have a lengthy period, constantly between 20 and three decades. It could and then make sense you to definitely that have a permanent business setting your danger of you to be able to shell out that loan for that enough time work better. But is it simply?

Loan providers and you will Long lasting compared to Contract Work

Minutes was changing. The employment rate is extremely chock-full of Southern Africa and and much more companies are hiring toward a good contractual basis and you will fewer somebody get hired towards the a long-term base. Meanwhile, financial institutions have to consistently benefit. The basic mechanism out-of a bank is to try to provide currency and you will earn profits on the attract. Having faster and you will a lot fewer anybody becoming forever operating, lending guidelines have to reduced change to complement within the a career landscape, or banks is certainly going out of business.

Might you Score A mortgage Versus A permanent Job?

The new small response is yes, you can get a mortgage instead a long-term employment. However, there are certain things that you’ll require set up before applying to own a home loan versus a permanent business. Which have a a position and you can borrowing reputation usually change your odds of going home loan.

As i desired to buy my personal very first property, Used to do an abundance of lookup on the whether or not I desired a good long lasting employment to track down a home loan. I experienced a maximum of five years functions sense, every less than fixed name price. We never ever removed home financing in the beginning because We heard some moments that you need to be forever useful to gain access to house money. Has just, when performing browse on the count, I discovered little on paper to ensure it. Thus i merely produced the application to ascertain to have myself.

Pre-Recognition

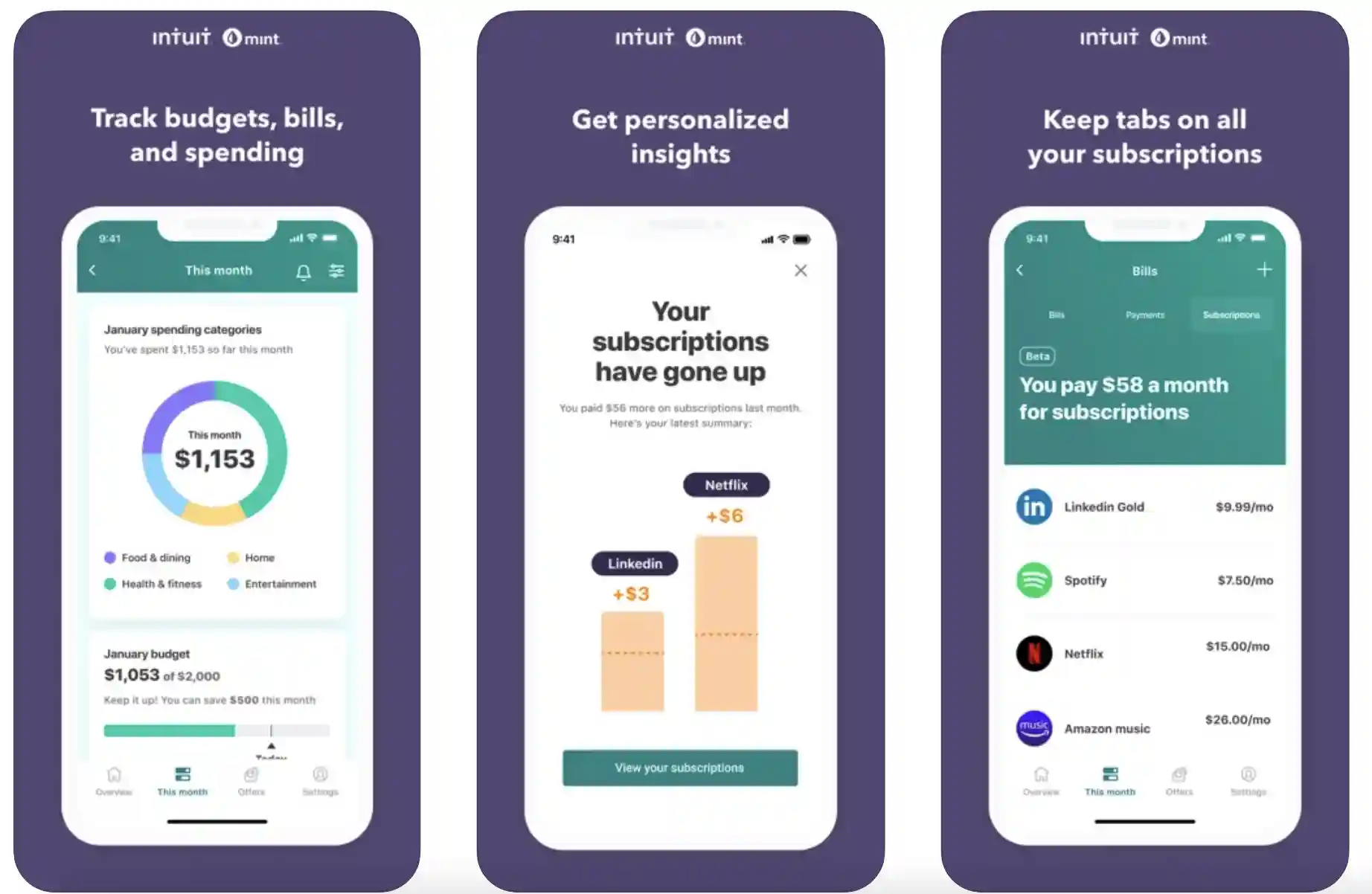

Exactly what prompted me to create a home loan software program is this new Nav >> Currency ability into FNB application. The fresh feature explained all the credit place which i meet the requirements to possess and you will below home loan, they mentioned that I do be eligible for a mortgage. This was once i will nevertheless operating just concert discount operate.

The brand new green club to own financial was not since the full because it’s today however, FNB performed render an explanation to your how exactly to improve it for the software. We handled improving it of the making sure I did not spend-all the bucks I experienced from inside the week. I experienced from the one third of your own currency I received for the a month left inside my membership at the end of the new day. Enough time to evolve it two where its (from all around 65% to over 85%) regarding the significantly more than photo try 4 months.

New FNB application also offers a substitute for get pre-accepted getting home financing regarding application and so i applied getting pre-acceptance while the next day I experienced a great pre-recognition email and a thread form.

Just after examining the application form, We saw there are an industry in which they inquired about permanent work. During those times, I decided to not apply for home financing from the bank. I might save having in initial deposit and implement using an excellent thread founder once i had secured the money.

Implementing Through A thread Maker

Immediately after rescuing up, We contacted a thread founder and they required by way of have a peek at this web site their very own pre-acceptance processes The cause of using thanks to a bond creator was which i understand in lot of articles one to bond originators are able so you’re able to discuss with the financial institutions in your stead. For people who implement by yourself, you cannot discuss and also the influence lies entirely precisely how their software seems in writing.

The fresh heartening most important factor of the application on the bond originator is that there is no question from the permanent work. Just after becoming pre-approved, We made an offer with the property I needed buying together with house broker submitted most of the files in order to thread originator. Within this a week, I’d a response throughout the first financial, proclaiming that they had approved my software the theory is that.

Employment And you may Credit status Once i Applied for Home financing

Whenever i produced my financial software I happened to be to the 2nd day away from a position to own a that will be I happened to be into the good step 3-times offer that we are yes was revived. I got recently been working an online jobs for annually in advance of one. I happened to be delivering a few salaries as i used but the financing matter which i try pre-recognized getting are maximum for what I will afford at the the afternoon employment where We brought a wages sneak.

My personal credit history status was classified due to the fact decent, that’s 4 regarding 5, otherwise one step beneath the best possible rating. It stems generally out of that have got vehicles loans for a couple of many years rather than forgotten a repayment to your auto. Outside one, my personal merely borrowing is actually a mobile-cellular telephone contract and you may good Telkom cell phone line which i got had for many ages.

My credit rating wasn’t spotless. The big question was to maybe not default into items that required a credit software. With been through an adverse patch couple of years early in the day, I’d defaulted into two things in the act. So if you create experience a difficult economic period, this isn’t the end of the country, you need to merely work tirelessly on fixing your credit rating.

Items that you should get a mortgage

- Payslip

- Good credit Record

- 3-6 months financial comments

Brand new payslip signifies that you are in reality functioning. The 3-half a year lender comments confirms you are bringing profit your account month-to-month and that you find the money for pay an excellent home loan. Good credit implies that you are a reliable debtor as well as have a high likelihood of spending your property financing.

End

You don’t have to possess a permanent business to track down an effective mortgage. The fresh new lenders’ main priority is promise your in a position to cover your residence loan. This is exactly showed using good credit reputation and you may a jobs updates that shows you are choosing adequate currency per month to pay for our home mortgage over a length more than per year.