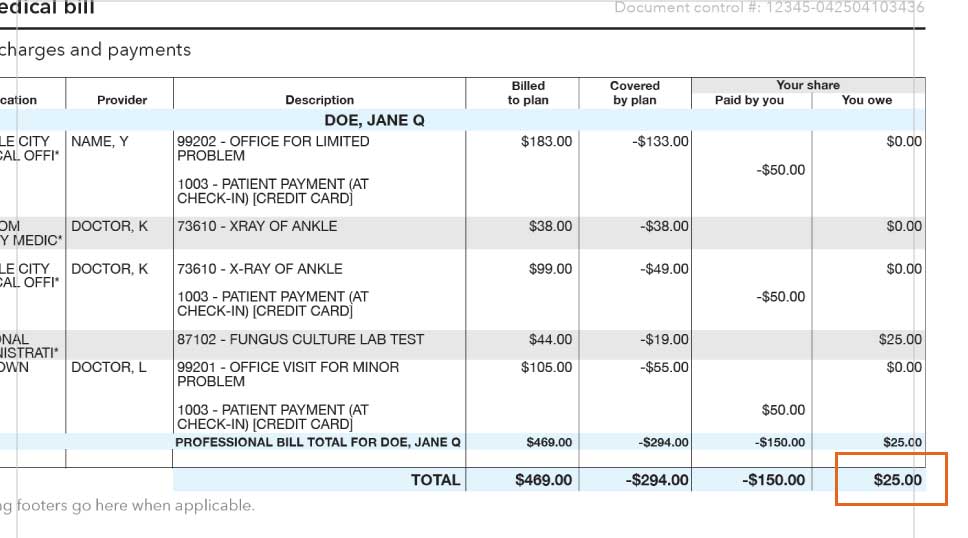

No. 3: Ca

- Average financial amount (): $509,516

- Average ): 5.18%

- Average ): six.94%

- Payment per month with average Apr: $step one,

- Payment per month with average Apr: $dos,

- Difference in payments that have average APRs: $

Towards the Government Set aside potentially positioned to avoid walking its address federal loans rates and you can rising cost of living proving signs and symptoms of going back below control, there clearly was way less reason for home loan pricing to begin with quickly hiking as with 2022. This is exactly some great news getting people, as it form they could not need to manage always ascending rates you to definitely threaten to help you speed them outside of the field once they dont buy instantaneously.

Yet not, this does not mean you to definitely home loan costs can begin indicating sustained declines any time in the future. To the contrary, regardless if this has been unstable into each week-to-few days foundation, the typical rate into the a thirty-12 months, repaired financial has constantly existed between 6% and seven% in 2010 – a development that looks planning to remain until the broader economy initiate experience a major lag. Unfortuitously, people commonly still have to browse an expensive housing market that’s generally speaking anything but amicable to the people without strong credit scores and you will lower obligations-to-earnings ratios. Even though pricing more than likely at some point go lower again, there isn’t any advising when which will occurs.

Regardless of the future, it is clear one to the present pricing enjoys and you may almost certainly continues to generate purchasing property costly. Even so, that doesn’t mean homebuying is actually an impossible https://cashadvancecompass.com/personal-loans-ny/cleveland/ task, in accordance with right planning, to find property could still be an excellent selection for of many anyone.

step 3 techniques for delivering a lower mortgage Annual percentage rate

Though rates are still apparently steep, there are several implies for borrowers so you’re able to potentially score a lowered Apr on their home loan. Listed below are about three guidelines on how to perform just that:

- Comparison shop for a home loan prior to purchasing. Since some other loan providers will offer different rates toward exact same consumers, homeowners could easily secure less rates by doing your research having a mortgage before buying a property. On occasion, a debtor will get found a speeds dozens of foundation things straight down than the first financial provided them. This down rates you could end up tens of thousands of dollars inside deals along side life of financing.

- Work on their credit. Since it is accustomed assess exactly how likely one is to repay its obligations, a credit rating is a vital component that loan providers think whenever deciding what rate supply a possible homebuyer. Compliment of it, borrowers is to work with to make its credit score because the good given that possible just before they make an application for home financing. Not only can a higher score help a great homebuyer get an excellent down rates, but it may also be helpful them get approved for a financial loan to begin with.

- Thought a mortgage that have a smaller title. Shorter-title funds will incorporate down rates than just their a lot of time-title equivalents. Such as, individuals with sophisticated borrowing from the bank normally typically be prepared to found an increase on an effective 15-season, fixed-speed home loan that’s more than 50 base facts lower than what they can expect to receive towards a thirty-12 months, fixed mortgage. Although a smaller loan label usually normally end in higher month-to-month costs, it is going to nonetheless result in shorter notice paid back along the life of a loan. This might be beneficial when you yourself have more money and do not attention an excellent steeper houses commission.

Methodology

Investigation within studies try generated of over 29,000 profiles just who received an offer for a 30-seasons, fixed-speed home loan on the LendingTree system within the .

So you can estimate month-to-month mortgage payments, LendingTree made use of the mediocre home loan numbers offered to users in the for each county in the therefore the mediocre and (due to April twenty two).