Posts

You are guilty of all the costs of employing this service membership and you will operating the brand new Get Tool, as well as, however simply for cellular and you may internet service charges. You are responsible for keeping the fresh human body’s skill and you may associations expected for use of your own Service. There is absolutely no extra payment for using Mobile Consider Put however, we recommend that your consult with your provider to see if the you’ll find one wireless provider charges.

- Customers just who be considered while the an associate of Well-known Banking applications have a good $ten,one hundred thousand everyday and you can $twenty five,100000 monthly restrict.

- When you’re ready, tap abreast of complete the mobile deposit techniques.

- Folks need plan all of the visits at the least a couple of days just before initiate date.

- To help you deposit the newest look at as a result of a bank app, get an image from both parties.

- Picture quality.You’re accountable for the image top-notch one Picture you to definitely you broadcast.

- Should your cellular look at deposit isn’t working and you also imagine you’ve over everything correctly, there is an issue with the cellular financial app.

You would be prompted to select other payment method whenever your consult a detachment. BT is the just British operator to allow payments from the landline, catering to help you customers who can be away from an older age bracket and you may less likely to want to very own a cellular telephone. It’s as well as a terrific option for participants just who misplace its mobile phones however, wear’t want to lose out on trying to its luck on the internet. It’s best that you learn whom part of the organization is for it service to make sure you’re also having fun with a reliable services after they show up on their mobile cellular phone expenses.

Fast forward to the modern point in time and you may … you continue to had to bring your papers view on the nearby bank department otherwise Automatic teller machine. Nowadays you might put a right from your family area in just a few moments, because of the mobile put element on your lender’s mobile app. As previously mentioned more than, just because your put a via your financial’s cellular app doesn’t indicate you could potentially throw out of the look at.

There’s no costs to make use of Cellular Deposit1

To take action, the player simply needs to take the fresh gambling enterprise website and go to the brand new financial part using a telephone. The website often inquire the gamer so you can input his or the woman cellular amount plus the wanted amount of deposit. Next a verification message was provided for make sure the protection of the phone number.

How come mobile put performs?

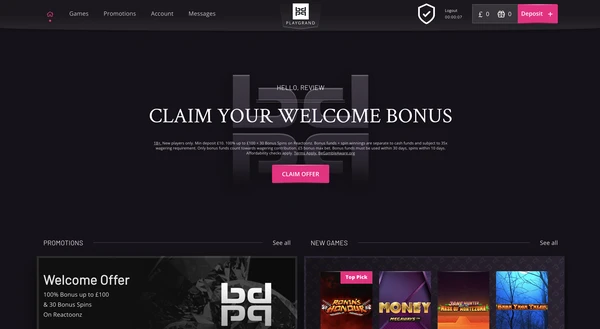

If you do anticipate playing thru mobile phone, you’re also set for a delicacy since the majority mobile brands of the favorite gambling enterprise still offer incentives that come with enrolling otherwise while the a publicity. You may then begin using the free takes on to play the newest cellular casino. Even if, investigate small print to your wagering standards first before trying in order to allege your own profits from all of these no-deposit bonuses since the local casino always requires a specific contribution to wager prior to earnings. However, it’s best not to ever explore social Wi-Fi the delicate information otherwise some thing requiring the financial password. It’s a good idea to make use of a safe wired otherwise wireless connection—or their mobile phone’s study connection—if you wish to stop sharing sensitive and painful advice. Mobile view places are generally safe, plus they can even stop certain types of fraud.

Mobile Put Limitations Can invariably Transform and you can Disagree By Membership

These limits might be according to the sort of account, your put record, the length of time the new membership has been open and other items that have your own financial relationships. When you’ve submitted the cellular put, the brand new app tend to broadcast every piece of information to the financial and also you would be to see a verification content. Based on when you deposit the brand new take a casinolead.ca inspect site look at, it might take a corporate day or two for the fund to become for sale in your bank account. Mobile take a look at put spends remote put take tech to put the newest take a look at fund in the savings account. That it unit lets financial institutions accept deposits using digital photos of one’s back and front away from a check as opposed to demanding the first paper view as in person transferred at the a branch otherwise Automatic teller machine.

Mobile take a look at put might be a convenient means to fix manage deposits so you can a verifying, discounts otherwise currency industry account. There are numerous banking companies and you may borrowing from the bank unions that offer mobile take a look at deposit because the a choice. If the financial institution doesn’t give it, you could consider starting a free account someplace else. Besides mobile put consider provides, here’s what you should think whenever changing banking institutions. Yet not, look at deposits usually takes a short time to pay off with many banking companies, however, some offer mobile view places that have instantaneous finance access.

When you’re also sure everything is direct, fill in the fresh take a look at for the bank and wait for its confirmation of the put. To be sure there aren’t any bugs along with your mobile deposit, take photographs of one’s sign in a highly-illuminated city and on a condo epidermis one to’s clear and ebony. Make sure that the fresh consider are completely inside body type one to the thing is that and that very little else can be seen. You’ll be led to help you breeze a picture of the front and you can right back of your own take a look at. Be sure to keep the check in a secure place unless you comprehend the complete put count placed in your account’s prior/recent deals. When you create, be sure to damage the new look at quickly by the shredding it or having fun with another secure approach.

Dumps built to your bank account in the shops from the Environmentally friendly Dot Network get bear a charge all the way to $cuatro.95 for every transaction. It’s also essential to ascertain whether or not the lender imposes one constraints to your amount of money — and/or number of money expenses — it requires for each and every Automatic teller machine purchase. The essential difference between “Depositor” and you will “Registered because of the” only applies to put membership that have a dependable Associate listed. For these deals, the primary membership holder’s name’s displayed while the “Depositor” plus the Respected Affiliate are exhibited while the “Submitted from the.” Determine or no Android permissions are preventing mobile put.

We could possibly found percentage from your affiliates for looked keeping their products. We could possibly as well as discovered percentage for many who simply click certain backlinks posted to the our very own webpages. Specific banking companies, including PNC otherwise United states Lender, will get make it a to clear inside exact same go out if deposited just before 10 p.yards. If you try in order to deposit the newest look at after that time, you’ll have in all probability to wait before the overnight because of it to pay off.

The new Navy Federal Credit Union privacy and you may shelter principles do not apply at the newest connected website. Particular checks takes expanded in order to process, so we may prefer to hold certain or the deposit for a little lengthened. We are going to inform you whenever we have to hold a deposit you need to include information about when you should predict your money. We’ll tell you whenever we have to keep a deposit and can include details about when you should predict your finances.