FAQ for USDA Mortgage brokers

An option factor that normally disqualify a property from a great USDA loan is actually their area. Simply qualities within the eligible rural portion, while the designated from the USDA, visit this site are eligible for this particular financing. At exactly the same time, the house or property can be used due to the fact borrower’s no. 1 household, maybe not to own financial support, agriculture, commercial, otherwise leasing objectives. It is far from precisely the the type of house that must see USDA financial criteria, the brand new debtor must be considered. Such as, the brand new borrower’s earnings must slide in USDA’s money constraints, and the very least credit score off 620 is normally called for.

Exactly what Credit score Needs having USDA Financial?

The financing rating to possess USDA loan recognition out-of approved mortgage lenders may vary dependent on hence financial otherwise representative youre talking to. Quite often, the minimum credit rating getting USDA funds are 620, many finance companies want a good 640 or 660 minimum credit ratings. The newest RefiGuide will allow you to see the most recent USDA mortgage criteria in order to be certain that you’re qualified to receive these outlying money system.

What is the USDA Do-it-yourself Loan?

The USDA’s Single Family relations Property Fix Fund and you may Has program (Point 504) has the benefit of financial help to own domestic enhancements. It gives lower-attract, fixed-price funds and you will gives to lowest-money outlying people having essential home repairs, renovations, developments, and you may variations.

Exactly what are the USDA Structure Loan Requirements?

A good USDA construction loan streamlines your house-building procedure from the merging everything below just one loan. So it zero-off, low-appeal mortgage is an excellent choice for lower-to-moderate-income people trying make a house during the a rural area. Brand new USDA framework-to-permanent funds is a kind of one to-day intimate financial backed by the brand new USDA.

USDA-Awarded Mortgage brokers

This new USDA along with things mortgage brokers directly to people who have the new best monetary you prefer or any other need. As a result the household must meet with the following the conditions:

- You don’t need a safe, pretty good or sanitary place to live

- You cannot score home financing of a typical financial

- You may have an altered income which is beneath the lower-income restrict in your area

USDA will usually present an immediate mortgage for an excellent home with 1800 sqft otherwise reduced, along with a market worth beneath the financing limitation on city. These amounts may vary reliant the space. An excellent USDA home mortgage will be $five-hundred,000 or higher for the Ca, so that as low because $100,000 for the elements of the brand new outlying Us. The us government even offers USDA- financing finance so you can certified individuals and eligible characteristics.

Belongings which are not Qualified to receive USDA Fund

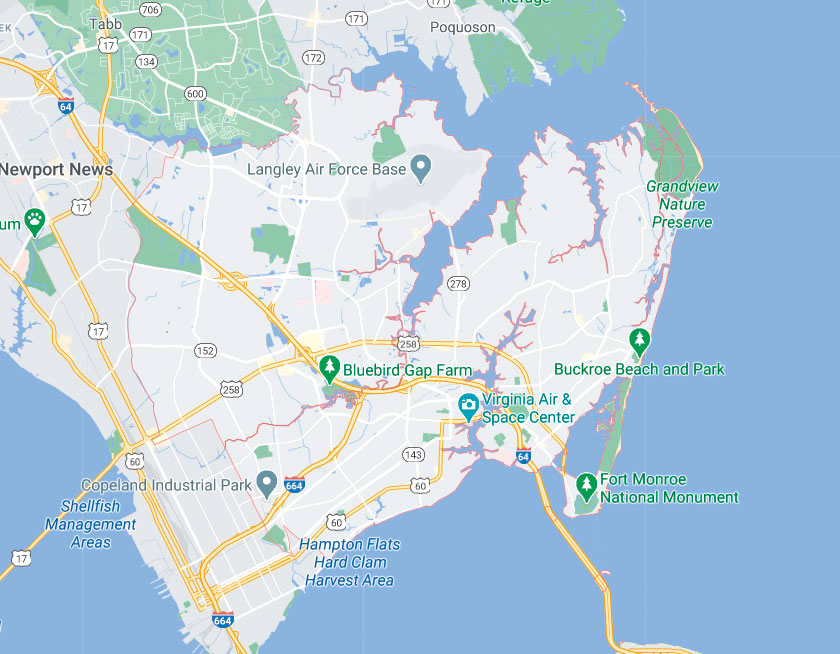

A major restriction from the system is that very locations dont meet the requirements. Just be located in an outlying urban area. But you will find several residential district elements that also.

How-to Apply for USDA Home loan

To try to get USDA home loan you need to talk to a accepted USDA outlying home loan company today. Just remember that , you don’t need to operate during the people sorts of globe so you’re able to be eligible for a rural financial away from this new USDA. There are also fund to have an initial-big date home buyer which have bad credit, if for example the borrower fits the USDA loan qualifications conditions.

People with a reduced income and a diminished credit score should think about protected finance. You can buy an incredibly low interest rate and you can zero off, 100% investment sometimes. Just make sure your considering home that can qualify for an excellent USDA financing system. Speak to your realtor and have your ex lover only assist you services that be eligible for a beneficial USDA outlying mortgage.